To paraphrase Ernest Hemingway, shifts in the stock market often occur “gradually, then suddenly.” Over the past month, the market has rotated from large cap

Read More

From President Biden’s announcement that he will not be seeking re-election, to a rotation out of tech stocks and into small caps, recent events have added to

Read More

The stock market has continued its historic rally with the S&P 500 gaining 19% year-to-date with reinvested dividends, contributing to a total return of 61%

Read More

The path of interest rates has been highly uncertain over the past few years due to inflation, economic growth, and the Fed. The 10-year U.S. Treasury yield

Read More

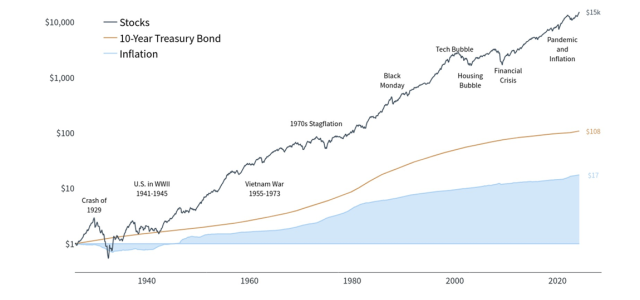

As with many things in life, knowing what we’re supposed to do and actually doing it are two separate things. This is true for our health, relationships

Read More

Investors and the financial media tend to focus on macroeconomic concerns such as inflation, labor markets, and the Fed. While these topics are important

Read More

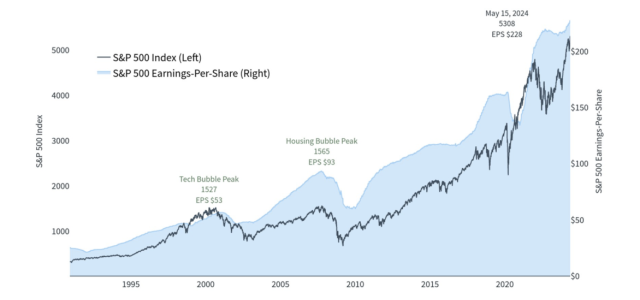

The Dow Jones Industrial Average reached 40,000 for the first time recently as markets continue to rebound from a 5% decline earlier this year. While this has

Read More

With markets nervous about stubborn inflation, a gradually slowing labor market, and the timing of the first Fed rate cut, investors are more focused on this

Read More

In times of market uncertainty, investors often seek the safety of cash. This has been true over the past several years as markets have swung due to the

Read More

The stock market has become increasingly jittery with the S&P 500 experiencing its first 5% pullback of the year. The possibility the Fed could delay its first

Read More

After a historically strong start to the year, markets have now pulled back 2.5% to begin the second quarter. Concerns around geopolitical tensions in the

Read More

As Benjamin Franklin famously said, “in this world, nothing is certain except death and taxes.” Taxes are no one’s favorite topic but their importance cannot be

Read More