Washington imposes an excise tax on certain long‑term capital gains realized by individuals (including grantor trusts). The tax was first effective for the 2022

Read More

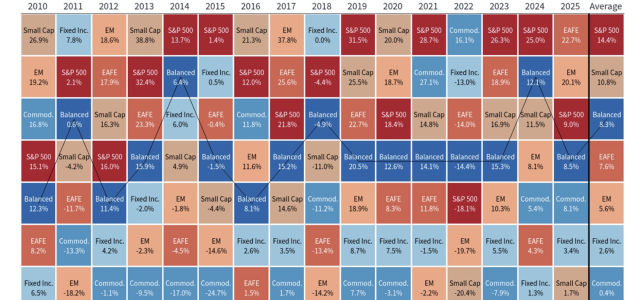

Diversification means spreading your investments across different types of assets—like U.S. and international stocks, bonds, and real estate—to reduce the risk

Read More

Recent tensions between the White House and Federal Reserve have brought the topic of Fed independence into focus. This is because there can be a natural

Read More

One of the biggest challenges for investors is balancing long-term goals with short-term market moves. New developments in the stock market, cryptocurrencies

Read More

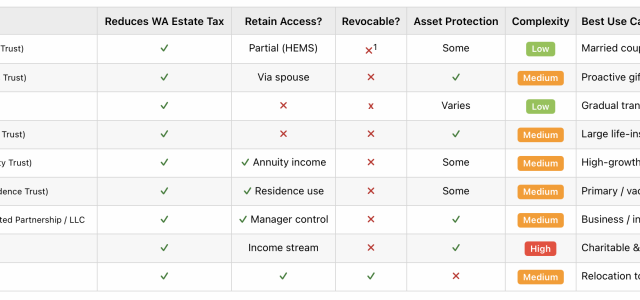

Washington has increased its estate-tax exemption to $3 million (up from $2.193 million) and adopted a new, more progressive rate schedule. The exemption will

Read More

After months of negotiations, a new tax and spending bill was approved by Congress and signed into law by President Trump on July 4. This new budget is far

Read More

For many Americans, the status of the U.S. dollar reflects the country’s position in the world. However, the dollar has weakened in recent months amid trade

Read More

Financial markets rebounded in May with the S&P 500 recovering its year-to-date losses. This positive month occurred against a backdrop of new trade agreements

Read More

It’s well known that stocks are one of the foundations of long-term portfolios. However, a natural question is: what type of stocks?

Read More

Moody's recent downgrade of the U.S. credit rating marks an official end to the country’s top-tier debt status. Following Fitch's downgrade in 2023 and Standard

Read More

The recent trade announcement between the U.S. and China reverses many of the tariffs that rattled financial markets beginning in April. What does this changing

Read More

A key principle of investing is that patience, discipline, and maintaining a long-term perspective are what drive financial success. Perhaps no investor has

Read More