“Diversification means always having to say you're sorry.”

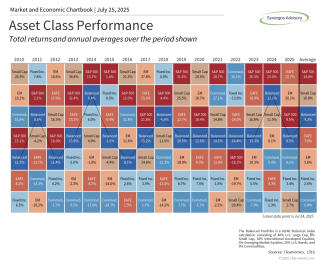

Diversification is the disciplined practice of not letting any single asset set the tone for your entire portfolio. By allocating money across a range of investments—U.S. and international stocks, various bond sectors, real‑estate securities, and beyond—you tap into multiple engines of growth and cushion yourself against any one market’s bad day (or bad year).

It won’t always feel rewarding in the moment; something in a well‑diversified portfolio is almost guaranteed to look “weak” at any given time. That seeming underperformance is precisely the point: when one slice lags, another often leads, helping smooth the ride and keep long‑term goals on track. In short, diversification trades a bit of short‑term excitement for a steadier, more resilient path to building wealth.

– Michael Portnoy

This quote resonates because diversification often feels like an apology for not chasing the best-performing asset. But the real apology comes when we abandon diversification and get caught with all our eggs in the wrong basket.

Why Don’t All Assets Move Together?

Different asset classes behave differently under varying economic conditions. For example:

- Stocks may do well during economic growth but can be volatile.

- Bonds tend to hold up when stock markets fall.

- Real estate may benefit from inflation but be sensitive to interest rates.

- International markets provide global growth exposure but carry currency and geopolitical risks.

When one part zigs and another zags, the goal is that your total portfolio moves more smoothly over time.

How to Think About Your Portfolio

Here are some helpful mindset shifts:

- Stop checking your portfolio like it’s a scoreboard. Investing isn’t a game with quarters—it’s more like watching grass grow. Patience pays.

- Judge the orchestra, not the soloist. Don’t fire a trumpet for being quiet during a flute solo. Every asset plays its part at different times.

- Embrace boredom. A well-diversified portfolio is designed to be intentionally unexciting. It’s not supposed to thrill—it’s supposed to work.

- Don't chase last year's winners. Often, the top-performing asset class one year is near the bottom the next. Staying diversified reduces this whiplash.

Behavioral Tips to Stay on Track

- Anchor to your goals, not headlines. News is designed to provoke emotion. Your plan is designed to reduce it.

- Expect discomfort. At least one part of your portfolio will underperform every year. That’s diversification doing its job.

- Review annually, not daily. Focus on progress toward your financial goals—not the month-to-month noise.

- Talk before you act. Before making changes, have a conversation with your advisor. Most mistakes happen in moments of panic or overconfidence.

Remember: We don’t diversify to guarantee gains. We diversify to manage the unknown. It’s an investment in resilience—so that when surprises come (and they will), you don’t have to start over.