AI Disruption and Tech Rotation

You may have seen recent headlines on the stock market’s reaction to new artificial intelligence (AI) tools. Specifically, the AI company Anthropic unveiled new capabilities, which affected the share prices of some companies involved in providing these services. This development represents another milestone in the evolution of AI and serves as a reminder of the importance of risk management while maintaining a balanced, long-term investment approach.

I want to provide perspective on what these developments mean for your portfolio and overall financial plan. The key takeaway is that while AI represents a potentially transformative technology, short-term market reactions do not change the fundamentals of sound investing. Your portfolio is designed to participate in long-term growth opportunities while also managing risk.

The impact of AI is still evolving

As computer scientist Roy Amara famously observed, we tend to overestimate the impact of technology in the short run and underestimate it in the long run.

Over the past several years, many AI companies predicted the rapid development of “artificial general intelligence,” or systems capable of matching or exceeding human abilities across a wide range of tasks. To date, that milestone has not been reached, and technical progress has slowed somewhat over the past year. Even so, AI is already supporting knowledge workers in meaningful and practical ways.

For investors, the challenge is that we are still in the early stages of adoption. The pace at which AI will be integrated into the broader economy, which companies will benefit most, and which business models may be disrupted remain difficult to predict. This uncertainty naturally contributes to market volatility as expectations evolve.

In theory, AI has the potential to increase productivity by automating routine tasks and augmenting human decision-making. Over time, higher productivity could support economic growth and corporate profitability, benefiting long-term investors. However, there is currently limited hard evidence of widespread productivity gains across the economy.

This gap between technological capability and measurable economic impact is not unusual. Past technological revolutions, including electricity and personal computing, took many years to show up in productivity statistics. The benefits often emerge gradually as businesses learn how to reorganize workflows and processes around new tools.

For investors, this means patience is required. The experience is similar to the internet boom of the 1990s, which unfolded over decades rather than months. While some businesses were disrupted quickly, many of the most meaningful changes occurred over time as new applications and business models emerged. The recent market reaction suggests that AI adoption may follow a similarly gradual path.

Valuations and the question of an “AI bubble”

|

A central question for markets has been whether AI-related enthusiasm has created a bubble. Technology-oriented sectors have been significant contributors to market returns in recent years, with some companies trading at historically elevated valuations. These valuations reflect optimism about AI’s long-term potential, but they also increase the risk of short-term pullbacks when expectations are not immediately met.

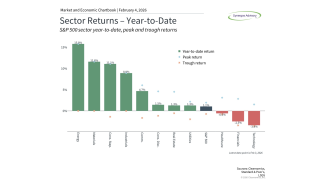

It’s important to remember that market corrections and sector rotations are a normal part of investing. Technology-focused sectors, in particular, tend to be more volatile. For example, during 2022 the Information Technology sector declined significantly as economic growth slowed and interest rates rose. Yet over longer periods, technology stocks have also delivered some of the strongest long-term returns.

This year, we have seen healthy rotation within the market as other sectors have performed well while Information Technology has lagged. This pattern reinforces the value of diversification: when one area of the market experiences volatility, others can help provide balance and stability.

What this means for your portfolio

These developments do not change Synergos's core investment philosophy or financial planning strategy. While technology stocks may experience periods of heightened volatility, they remain an important component of a well-diversified portfolio designed to support long-term goals.

If you have questions about how ongoing AI developments might affect your portfolio, or if your personal financial situation has changed, please reach out. In the meantime, the best course of action is to remain focused on your long-term objectives and maintain the investment discipline that has served you well.

Synergos Advisory LLC doing business as Synergos Advisory is an Investment Adviser registered with the State of Washington. All views, expressions, and opinions included in this communication are subject to change. This communication is not intended as an offer or solicitation to buy, hold or sell any financial instrument or investment advisory services. Any information provided has been obtained from sources considered reliable, but we do not guarantee the accuracy or the completeness of any description of securities, markets or developments mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this communication’s conclusions. Please contact us at 206-800-8056 if there is any change in your financial situation, needs, goals or objectives, or if you wish to initiate any restrictions on the management of the account or modify existing restrictions. Additionally, we recommend you compare any account reports from Synergos Advisory with the account statements from your Custodian. Please notify us if you do not receive statements from your Custodian on at least a quarterly basis. Our current disclosure brochure, Form ADV Part 2, is available for your review upon request, and on our website, www.synergosadvice.com. This disclosure brochure, or a summary of material changes made, is also provided to our clients on an annual basis.