How the Great Wealth Transfer Creates Financial Planning Opportunities

“Life affords no greater responsibility, no greater privilege, than the raising of the next generation.” This statement by former United States Surgeon General C. Everett Koop underscores what for many is the ultimate goal: leaving a lasting legacy beyond our own financial security.

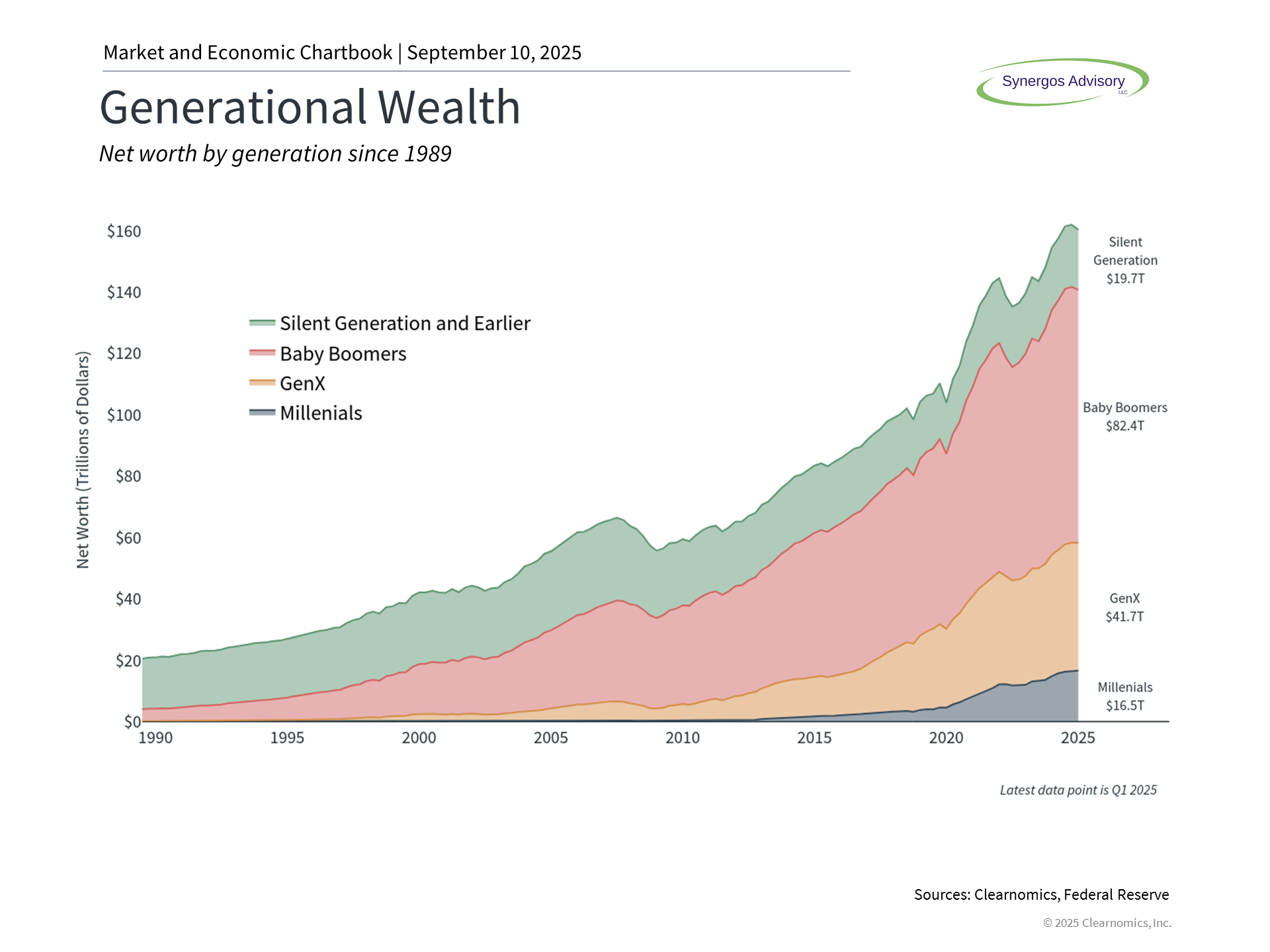

Over the next two decades, an estimated $84 trillion will transfer from the Silent Generation and Baby Boomers to younger generations, in what economists call the Great Wealth Transfer.1 This shift represents more than just money changing hands – it's already reshaping how families think about financial planning, charitable giving, and building lasting legacies with advanced planning strategies.

For many investors, this wealth transfer represents both opportunity and responsibility. Whether you're preparing to leave assets to future generations or expecting to receive them, understanding how to navigate this transition thoughtfully can be the difference between preserving wealth and experiencing unintended outcomes that may not align with the original legacy goals. The key lies in embracing a more comprehensive approach to generational wealth transfers.

Why the Great Wealth Transfer matters

|

The size and structure of wealth transfers have evolved over the past few decades. Unlike previous generations who relied primarily on pensions and Social Security, today's retirees have accumulated substantial assets in retirement accounts and investment portfolios. Baby Boomers, those between 61 and 79 years old in 2025, now hold over $82 trillion in wealth according to the Federal Reserve.

This increase in wealth is structural, with more people living longer, an extended period of financial market performance, and a broader transformation from defined benefit pension plans to retirement plans like 401(k)s and individual retirement accounts (IRAs). While this change placed more responsibility on individuals to save for retirement, it also created larger pools of investable assets that will eventually pass to heirs. The result is that more families than ever before are dealing with significant wealth transfer considerations.

Planning your wealth transfer can secure a lasting legacy

|

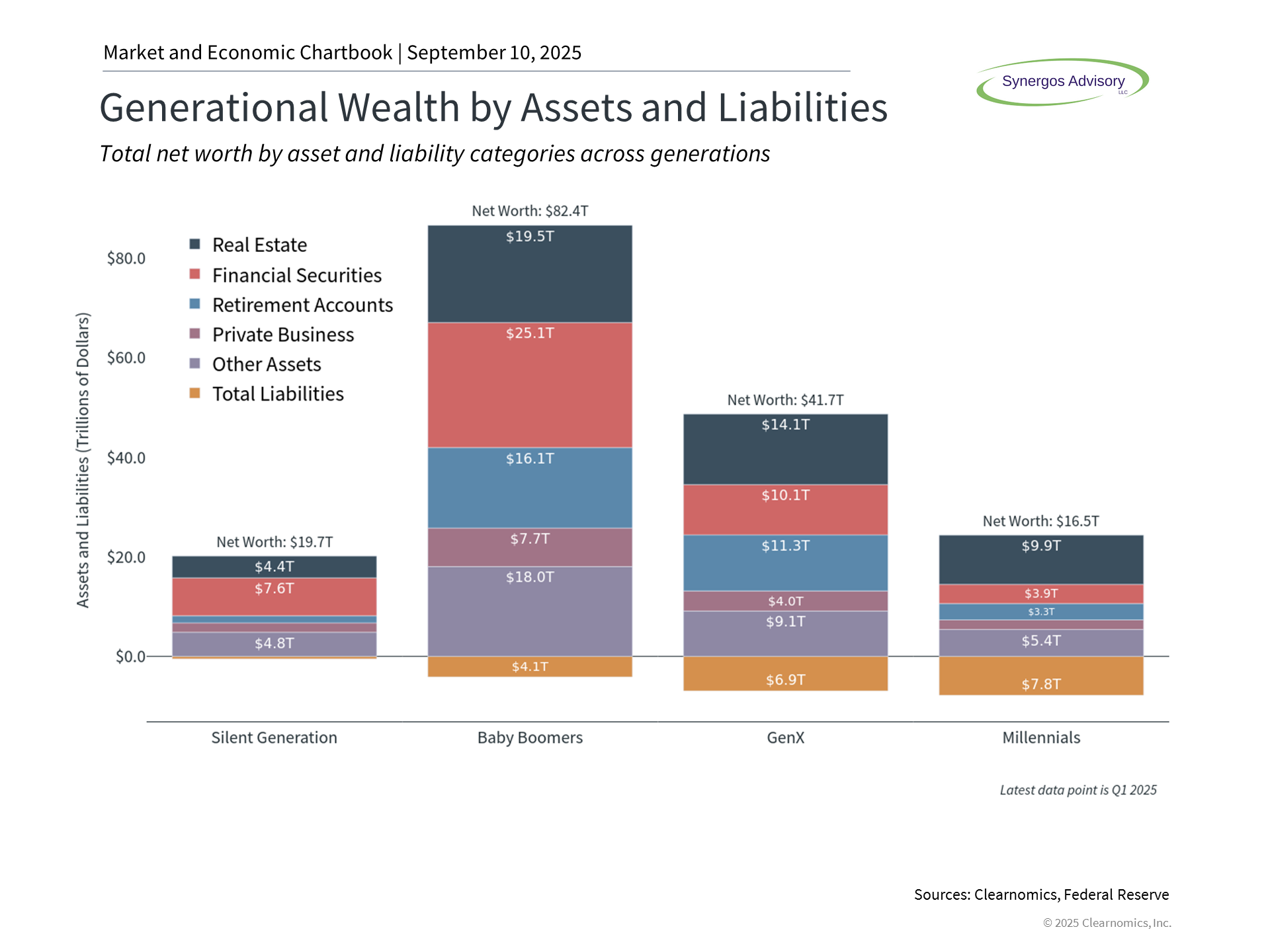

What makes this particularly important is that these assets often represent decades of disciplined saving and investing. Today's wealth transfers frequently involve diversified investment portfolios, multiple retirement accounts, and various tax-advantaged savings vehicles. On top of inherited real estate or family businesses that previous generations might have passed down, each of these requires careful planning to ensure smooth transitions and optimal tax treatment.

This means that estate planning is more important than ever. While many think of estate planning as setting up a will and related documents like a durable power of attorney and advance healthcare directives, thoughtful wealth transfer encompasses more than just the assignment of assets. By considering how your wealth can create meaningful impacts, optimizing for taxation and managing complex or illiquid structures, investors can create a lasting legacy.

Importantly, while everyone's asset base and legacy intentions are different, the foundations are similar. Just as Maslow's hierarchy of needs helps us understand human motivation - where basic needs like food and shelter must be met before people can focus on higher aspirations - a similar progression applies to wealth planning. Once you've built sufficient retirement savings to cover your basic needs, the focus can shift to creating meaningful impact with your wealth.

Keep in mind that many wealth transfer disputes arise not from insufficient assets, but from complex structures, unclear intentions, or lack of preparation among heirs. A holistic wealth transfer strategy should encompass values, expectations, and financial responsibility to ensure smoother transitions.

Strategies to optimize wealth transfers

Turning to actionable strategies, some of the most important decisions in optimizing a wealth transfer involve timing and taxes. Here are just a few impactful strategies to consider:

1. Tax-Efficient Lifetime Giving. Giving during your lifetime isn't appropriate for everyone, as it requires confidence that you won't need the gifted assets for your own retirement security, especially given increasing healthcare costs and longer life expectancies.

That said, annual gift tax exclusions allow an individual to transfer up to $19,000 per recipient in 2025 without reducing your lifetime estate tax exemption. Lifetime giving can also provide practical benefits beyond tax savings. You can observe how recipients handle the money, provide guidance on financial management, and enjoy seeing the positive impact of your generosity.

For those interested in charitable giving, there can be significant tax advantages to gifting into a donor-advised fund, and involving family members in philanthropic decisions can help pass down values along with wealth.

2. Multigenerational Education Funding. By investing in education, you can provide young family members with the tools and knowledge needed to build successful futures. This can be particularly significant given that college costs have significantly outpaced inflation over recent decades, so helping with these expenses can make a huge difference.

Unlike other gifts, payments made directly to educational institutions for tuition don't count against annual gift tax exclusions, making this an especially tax-efficient wealth transfer strategy. Additionally, contributions to 529 education savings plans offer unique benefits for legacy planning, as you can contribute substantial amounts while retaining control over the account. 529s can be used for K-12 tuition, college, and even student loan repayments.

For larger families with multiple grandchildren or great-grandchildren, education trusts may also be considered. While education trusts can add complexity, they can also help ensure equitable treatment across beneficiaries, supporting multigenerational family members over time and creating an enduring legacy.

3. Asset Location Strategies. Asset location involves strategically placing investments within different account types - taxable, tax-deferred, and tax-free - to maximize outcomes.

By thoughtfully considering your financial structures and mapping certain assets to certain bequests, you can ensure you and your beneficiaries get the most out of your money. You can even use techniques such as tax-loss harvesting to minimize any tax implications.

For example, if you have large unrealized capital gains in a taxable account, you have options to minimize the tax burden. This might include waiting until after death for the cost basis to “step up,” or potentially deciding to gift that asset to charity over time. If done thoughtfully, gifting could provide the double benefit of upfront tax deductions along with not having to realize the tax on that gain.

4. Advanced Estate Planning. As wealth transfer amounts increase and tax implications become more complex, advanced estate planning techniques can also become beneficial.

This might involve trusts that distribute assets over time, including specific provisions or charitable components that involve the next generation. The complexity of modern wealth transfer also extends to business interests, retirement account beneficiary designations, and coordination between different types of liquid and illiquid assets.

All of these strategies require specific expertise to ensure optimal outcomes and avoid unintended consequences. Yet, the opportunity to help future generations succeed has never been brighter.

The bottom line? The Great Wealth Transfer represents a historic opportunity to create lasting impact across generations. Whether you're preparing to transfer wealth or expecting to receive it, thoughtful planning can help ensure your family's financial legacy serves its intended purposes.

1. https://www.cerulli.com/press-releases/cerulli-anticipates-84-trillion-in-wealth-transfers-through-2045

Synergos Advisory LLC doing business as Synergos Advisory is an Investment Adviser registered with the State of Washington. All views, expressions, and opinions included in this communication are subject to change. This communication is not intended as an offer or solicitation to buy, hold or sell any financial instrument or investment advisory services. Any information provided has been obtained from sources considered reliable, but we do not guarantee the accuracy or the completeness of any description of securities, markets or developments mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this communication’s conclusions. Please contact us at 206-800-8056 if there is any change in your financial situation, needs, goals or objectives, or if you wish to initiate any restrictions on the management of the account or modify existing restrictions. Additionally, we recommend you compare any account reports from Synergos Advisory with the account statements from your Custodian. Please notify us if you do not receive statements from your Custodian on at least a quarterly basis. Our current disclosure brochure, Form ADV Part 2, is available for your review upon request, and on our website, www.synergosadvice.com. This disclosure brochure, or a summary of material changes made, is also provided to our clients on an annual basis.