Washington Estate Tax Update – Effective July 1 , 2025

Washington Estate Tax Changes – Effective July 1 , 2025

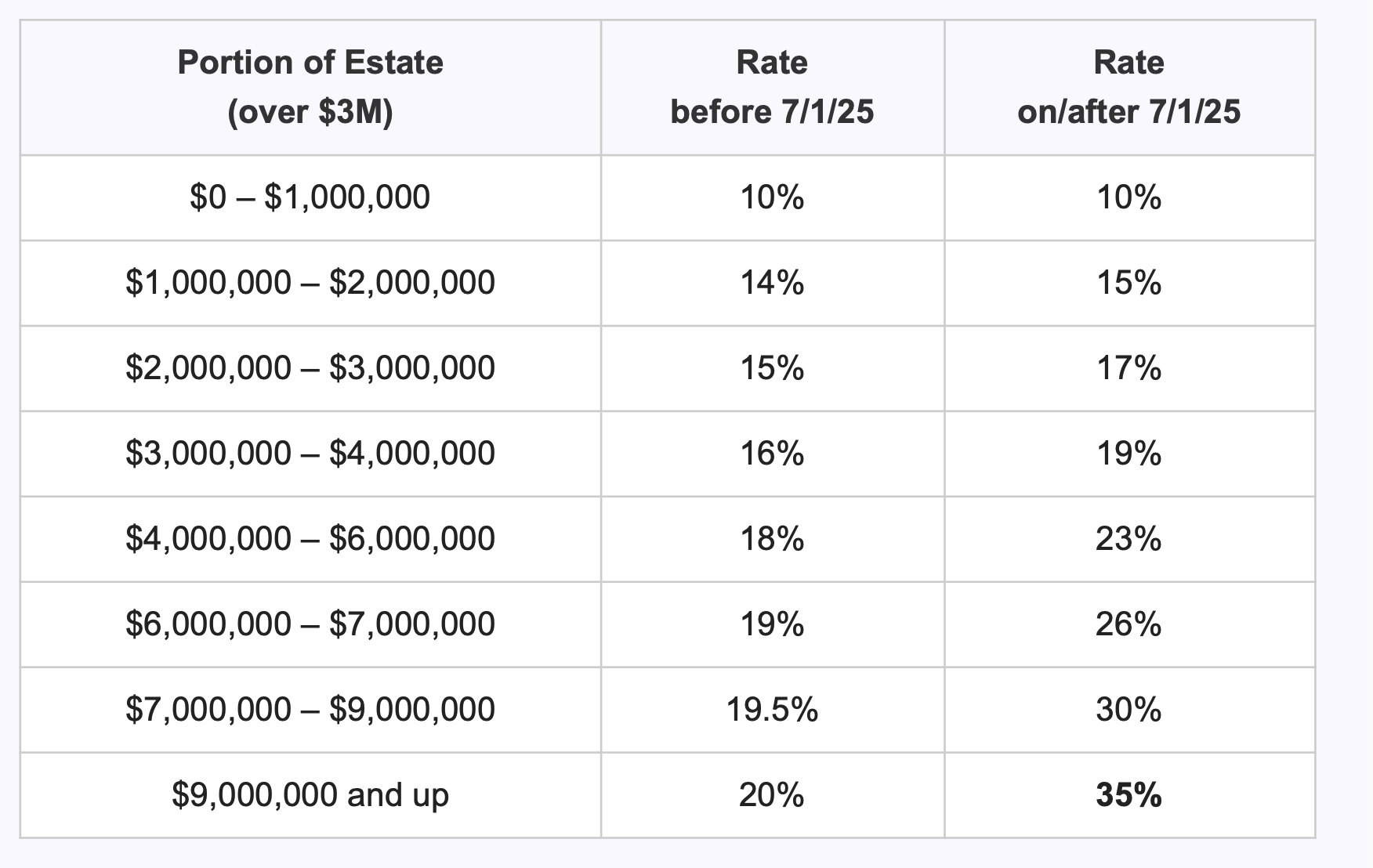

Washington has increased its estate‑tax exemption to $3 million (up from $2.193 million) and adopted a new, more progressive rate schedule. The exemption will be indexed for inflation beginning in 2026. Washington state still lacks federal‑style portability—planning remains critical.

New Marginal Tax Rates

The image below shows the old and new marginal brackets applied to the portion of the estate that exceeds the $3 million exemption. Click to open a larger version in a new tab.

Key Takeaways

- Larger Exemption: Couples may shield up to $6 million with proper planning.

- Steeper Rates for Large Estates: Estates above $9 million now face a 35 % state levy.

- No Portability: Washington still lacks federal‑style portability—planning remains critical.

- Federal vs. State: Federal exemption is currently $13.99 million increasing to $15 million January 1st, 2026, per person; Washington’s lower threshold often drives the analysis.

Portability: Federal vs. Washington

Federal Portability: Under federal law, if a married person dies and doesn’t use their full estate‑tax exemption, the surviving spouse may elect to use the deceased spouse’s unused exemption (“DSUE”). This lets the couple combine exemptions, potentially reducing or eliminating federal estate‑tax liability on the survivor’s estate.

Washington State’s Lack of Portability: Washington does not offer a similar provision. Each spouse has an individual state exemption, and any unused portion from the first spouse to die is lost unless proactive planning is in place.

Impact on Estate Planning: Because the state rules differ from the federal rules, Washington couples must plan strategically—often through trusts or lifetime gifting—to ensure both exemptions are fully utilized and to minimize potential state estate taxes.

Estate‑Planning Strategies at a Glance

Below is a chart outlining various strategies that may reduce or eliminate Washington estate‑tax liability. Click the image—or the button below—for an interactive view.

For Informational Purposes Only

The content provided by Synergos, including investment commentary, tax analysis, and planning tools, is for general informational purposes only and should not be construed as personalized financial, investment, tax, or legal advice.

Not Investment or Tax Advice

Any investment recommendations or tax projections are illustrative in nature and do not constitute specific advice. Clients should consult their own financial, tax, or legal professionals prior to making any decisions based on information received from Synergos.

No Fiduciary Relationship Implied

Engaging with Synergos tools or analyses does not establish a fiduciary relationship unless explicitly stated in a signed advisory agreement.

Assumptions and Estimates

Investment returns, tax savings, and other forecasts presented are based on assumptions that may not reflect actual future conditions. Projections are not guarantees of future performance or outcomes.

Tax Law Considerations

Tax laws are subject to change and vary by jurisdiction. While we strive to stay current, Synergos does not warrant the accuracy or completeness of tax‑related information provided, and clients should verify with a qualified tax professional.

Third‑Party Data

Some analyses may rely on third‑party data providers. Synergos cannot guarantee the accuracy, timeliness, or completeness of data provided by external sources.

No Product Endorsement

Any mention of specific financial products, platforms, or service providers is for illustrative purposes only and does not constitute an endorsement or recommendation.

Client Responsibility

Clients remain responsible for implementing any investment or tax strategy unless otherwise engaged for implementation services.

Confidentiality and Security

Synergos uses reasonable safeguards to protect client data, but clients are encouraged to avoid sharing personally identifiable information (PII) through unsecured channels.